Budget, Taxation Turmoil and Policy Blunders – Part II

Last week, we delved into a significant event in New Zealand, where a group of affluent individuals expressed a willingness to voluntarily pay more taxes, only to have the tax authority reject their offer. This incident prompts questions about the fairness of the current tax system, particularly in relation to the lower tax rates paid by the wealthiest citizens. Drawing parallels with Sri Lanka, the discussion advocates for the implementation of mandatory Tax Identification Numbers (TINs) in developing economies, underlining the necessity for a more equitable tax system.

Last week, we delved into a significant event in New Zealand, where a group of affluent individuals expressed a willingness to voluntarily pay more taxes, only to have the tax authority reject their offer. This incident prompts questions about the fairness of the current tax system, particularly in relation to the lower tax rates paid by the wealthiest citizens. Drawing parallels with Sri Lanka, the discussion advocates for the implementation of mandatory Tax Identification Numbers (TINs) in developing economies, underlining the necessity for a more equitable tax system.

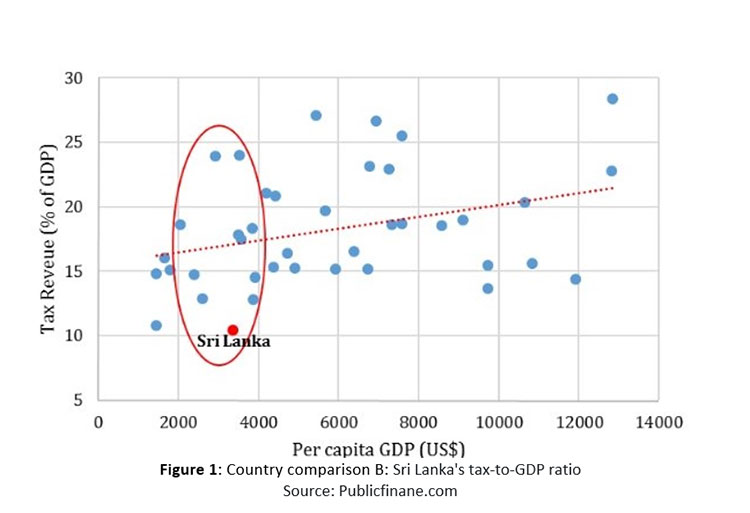

We observed a unique situation in Sri Lanka where, despite per capita GDP growth, the tax-to-GDP ratio has been on a decline. The introduction of some naïve tax policies, such as the abolition of mandatory PAYE Tax, the increase in tax and VAT allowances, in 2019/2020, were also discussed.

The projection for Sri Lanka’s tax revenue as a percentage of GDP is expected to rise from 7.3% in 2022 to 12.1% in 2024, with the World Bank emphasizing the importance of maintaining tax revenues above 15% of GDP for economic growth. Projections for Sri Lanka’s GDP per Capita indicate a gradual increase over the next few years, reaching around US$4098.00 in 2025.

Sri Lanka compared

According to a map available on the Internet, depicting global comparison of Tax-to-GDP ratio, Sri Lanka is bracketed with several economically challenged African nations as well as Afghanistan and Bangladesh within its region. Notably, it ranks lower than many neighbouring countries including India, Nepal, Bhutan, Pakistan, and Indonesia etc.

On the contrary, countries with higher income levels, such as US, UK, Australia and any European countries, demonstrate considerably elevated tax-to-GDP ratios, ranging from 20% to 30%, and, in some cases such as UK France, the Netherlands, New Zealand and Denmark, reaching as high as 40% to 45%.

Figure 1 plots countries based on their GDP per capita and tax revenue as a percentage of GDP. Countries with income levels like Sri Lanka (ranging between US $2,000-4,000) are highlighted within the circle. Sri Lanka’s tax-to-GDP ratio falls significantly below the average. For instance, Morocco and Georgia, with GDP per capita figures of US $2,931 and US $3,529, respectively—comparable to Sri Lanka’s GDP per capita of US $3,369—both countries collect 24 percent of GDP as tax revenue, whereas Sri Lanka collects only 11 percent.

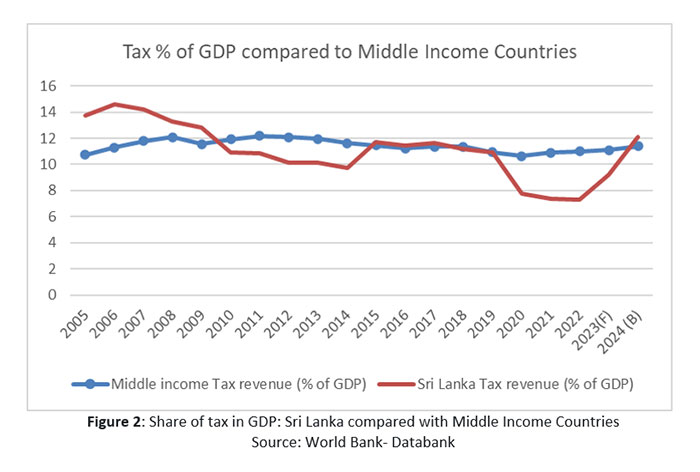

The tax revenue as a percentage of GDP for middle-income countries has shown a relatively stable trend over the years. The values range from around 10.7% in 2005 to an expected 11.4% in 2024 (Forecast).

Sri Lanka’s tax revenue as a percentage of GDP has experienced fluctuations during the period. Notable peaks are observed in 2006, 2007, and reaching up to 14.6% in 2015 and was par with the Middle-Income countries, followed by a decline again from 2019. The values have varied, with a dip to 7.8% in 2021, indicating a substantial decrease. Projections for 2022 and 2023 show a gradual increase, with the budget for 2024 aiming at a significant rise to 12.1%. (See Figure 2).

Hence, the tax revenue for Sri Lanka, while exhibiting fluctuations, generally appears to be on a recovery path after a notable decline in recent years. The budgeted figure for 2024 suggests an ambitious target, aiming for a substantial increase in tax revenue as a percentage of GDP.

Not only arbitrage but

also corruption

In countries like the United States, income tax stands out as the primary revenue source. This is facilitated by nearly zero import duties, typically set at 5 percent or less, and the absence of a value-added tax (VAT). In contrast, Europe relies heavily on a value-added tax, often around 20 percent, but does not impose import duties. In Sri Lanka, despite the relatively high import duties borne by the average citizen, the government only receives a fraction of this revenue. This is a result of the diversion of substantial sums to domestic protectionists through the practice of tax arbitrage, coupled with instances of tax avoidance (commonly referred to as tax minimization) and evasion, often involving manipulations and collusion.

Tax arbitrage involves exploiting differences in tax policies or rates across different jurisdictions to gain a financial advantage. In the context of domestic protectionists, individuals or entities within a country capitalize on tax differences among regions. This strategy often involves the strategic use of tax regulations or loopholes to minimize or entirely avoid tax liability. Notably, corruption plays a crucial role in this dynamic. Given the prevalent culture of corruption, extending from the top echelons of the state to even lower-level positions in Sri Lanka, these tactics can be readily implemented by astute business individuals, both on a large and small scale.

Not only anomaly but

also corruption

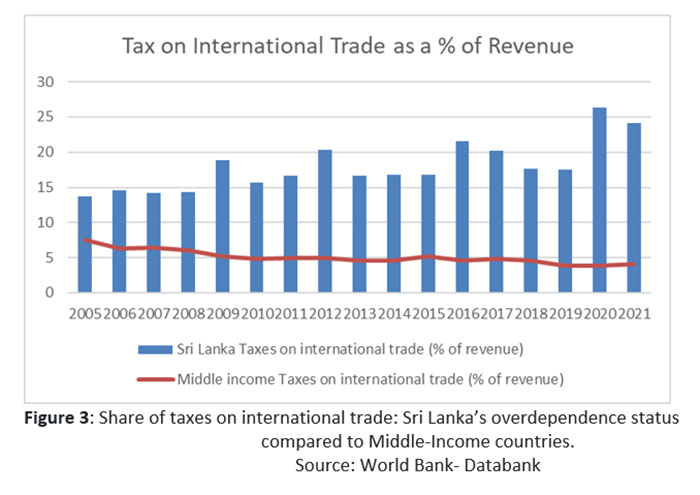

A noteworthy aberration in Sri Lanka’s tax structure is its disproportionate reliance on taxes related to international trade for tax revenue in comparison to its income level. Global patterns indicate that the proportion of taxes on imports as a share of total tax revenue tends to decrease as income levels rise. For instance, a study by Loewy, titled ‘Taxation: 21st Century Issues and Challenges’, revealed that trade taxes contribute to approximately 25% of total tax revenue in low-income countries, 12% in lower-middle-income countries, 9% in upper-middle-income countries, and less than one percent in high-income countries.

Contrary to these trends, in Sri Lanka’s case, taxes imposed solely on imports constitute nearly 20% of the government’s total tax revenue—a significantly high figure for a lower-middle-income country (Figure 3). The country’s substantial reliance on international trade for tax income has proven to be a risky proposition for the government. While restricting imports is essential to address the trade deficit, it comes at the cost of reduced government revenue and an exacerbated budget deficit. Conversely, increasing imports would boost government revenue but intensify the trade deficit. Consequently, a strategic shift away from trade-related taxes becomes crucial for the government to generate revenue without destabilizing the country’s macroeconomic environment.

Share of expenses on government servants

Government spending in Sri Lanka was 48% in 2019 to public sector salaries and pensions but now only 44% allocated for 2024 as mentioned before. In the most recent budget presentation, over 35% of government expenditure was directed towards public sector salaries, pensions, and public welfare, emphasising their importance in government spending. In a specific breakdown, it is mentioned that Rs. 92 billion was allocated to pay the salaries of public sector employees in July 2022. Moreover, a historical perspective indicates the significance of government spending on salaries, dating back to 1950. Overall, public sector salaries and pensions play a crucial role in Sri Lanka’s government expenditure, reflecting a substantial commitment to the welfare of government employees.

Another anomaly is too many armed forces

Sri Lanka’s armed forces strength of 317,000 personnel is financially unsustainable because of its considerable annual expenditure of Rs.423 billion (410 in 2023), which is 1.88% of the GDP. Comparisons with other nations, including Australia and the Netherlands, reveal significantly smaller military forces. Sri Lanka’s post-civil war armed forces maintenance highlights the country’s unique revenue-based fiscal consolidation strategy, focusing on tax increases without traditional cost-cutting measures.

Conclusions

This analysis reveals three main anomalies in Sri Lanka’s tax structure, including a decline in taxpayers after significant tax cuts. The essay emphasizes the importance of sustaining tax revenues for economic growth and explores the country’s tax-to-GDP ratio, positioning it against global comparisons (over 15% of GDP). Notably, it highlights the overdependence on international trade taxes, the disproportionate spending on government servants, and the financial challenges posed by the substantial size and expenditure on the armed forces. The narrative suggests a need for strategic reforms to navigate the intricate fiscal landscape.

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT University, Malabe. He is also the author of the “Doing Social Research and Publishing Results”, a Springer publication (Singapore), and “Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for.)